As The RTC Group reflects on its strategies for 2014, we review the results of both our own internal research and that of the general B2B market. Folio Magazine continues to provide some helpful insights on where sophisticated marketers are pointing their efforts, and in many ways their research supports what The RTC Group sees happening in the industry.

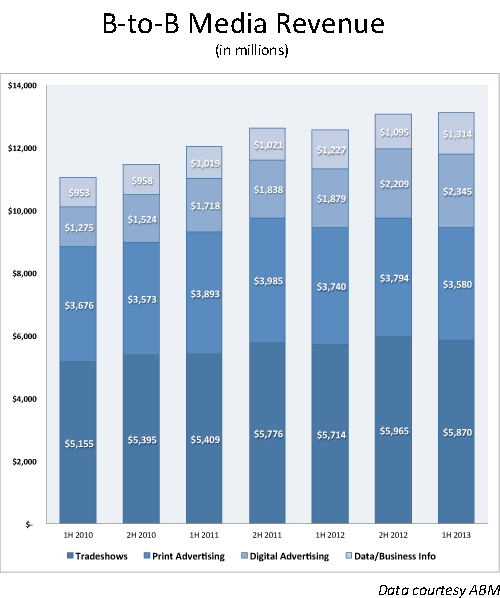

Below is Folio’s B2B Media Revenue Report for the past few years.

Tradeshows continue to account for nearly half of total earnings ($5.8 billion; 45 percent) in b-to-b media, but growth in the sector fell to just 2.7 percent—less than half of what its rate last year. The Center for Exhibition Industry Research (the source for ABM’s data) notes that there have been 12 positive quarters in a row, but warns that “there will be minimal growth through 2013.” – Folio Magazine

Trade show activities continue to dominate The RTC Group’s efforts and offerings. We are seeing a move away from webinars (as external marketing vehicles) and a move toward customized partner events supported by strong anchor technology leaders. The RTC Group sees amplified declines in larger events due to market challenges, including US budget woes and sequestration. Conservative marketers who’ve held on to marketing budgets are starting to loosen the purse strings and invest back into anemic product offerings and atrophied brands in 2014. Events have always been favorites among B2B marketing leaders trying to revive struggling sales and waning brands.

Driven by advances in mobile, digital advertising revenues spiked 24.8 percent in the period, topping $2.3 billion. Growth was just 9.4 percent last year.

However, as a percentage of total dollars, digital isn’t moving very fast. The segment now accounts for 18 percent of industry revenue, which is just 7-percent more than it did in 2008—when the iPhone had just come out and tablets didn’t exist.

The RTC Group is seeing our media space again amplify this trend. As mobile provides less viewership than anticipated (approximately 3% across all business units), and web browser viewership stabilizes, the continued dominance of print advertising is being reinforced. (Especially in military and aerospace markets where digital penetration is guarded by strict firewalls and electronic security.) Additionally, the lack of clear qualification and circulation of digital viewership control seems to amplify the need for a strong balance between print and digital options.

We are seeing a renaissance of traditional marketing principles as experienced marketers realize the need for balance between lead-generation, branding and educational requirements within the market. 2014 is looking to be a stabilizing year for the embedded and high-performance computing industry.

To read the entire article go to: Folio Magazine